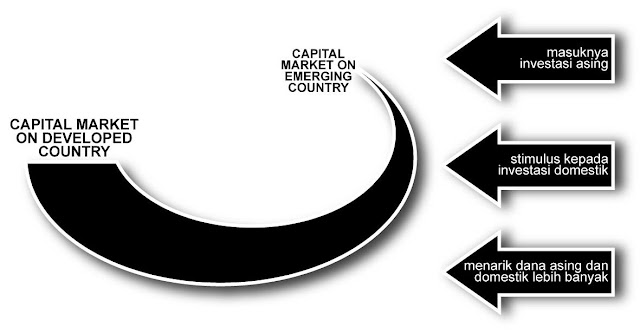

In the current era of globalization, where the barriers of the economy increasingly faded, the transition of the flow of funds from the surplus to the deficit will more quickly and without a hitch. Capital markets as the investments against a flow of funds from the excess wealth (the surplus) to the lack of funding (deficit) acts as a financial intermediary institutions. Investors here are the parties in relation to a financial surplus.

Who are the parties to this surplus?

In terms of investment and funding sources in the uses, investors can be divided. First, domestic investors is that is was an investor who came from within the country that make up the portfolio of assets in the domestic capital market. The second is the foreign investor, that investor has a number of funds from abroad that make up its assets portfolio on a number of different countries.Foreign investment coming to other countries actually has a classic motif, a motif that includes looking for raw materials or natural resources, find new markets and minimize costs. From the classic motifs sometimes investors have other motives, namely the motive to develop the technology. Investors are channeling their funds to other countries don't usually carry only one motive, but it could be because some motif at once.

There are at least four ways investors can enter a country:

distressed asset investment, strategic investment, direct investment and portfolio investment. Distressed asset investment is investment made to acquire ownership or purchase debt of a company in financial difficulties. Second, strategic investment in general foreign investor acquiring a company that has a large enough market share and be in business segments as well as a location factor supporting the company's expansion strategy for investors. A third i.e. direct investment (direct investment) usually takes place on a sector that has not been so developed, such as the development of technology-Laden or development in the automotive sector, usually a company. The fourth is a portfolio investment, namely investments in the debt and stock in the capital markets.Portfolio investment this is a concern for many practitioners in the field of capital market.

Why is this so?

Because this type of investor is the fastest moving exposure in a country if there is turmoil (politics, economy, exchange rate) that interpreted as uncertainty. They also are investors who have the most extensive selection compared to the three types of investors. So if there is a specific occurrence either in moral macro, or Government Regulation, then the investor this is a more vulnerable and sensitive to reflection on the information. The magnitude of the value of foreign investment into or out of practical, will also affect the overall market due to the large volume of transactions.

The role of foreign capital in the country's development has long been criticized by experts for economic development. Outline according to Cheney and Carter: first, an external source of funding (foreign capital) can be utilized by the emerging country as the basis for investment and accelerate economic growth. Second, the increased economic growth needs to be accompanied by changes in the structure of production and trade. Third, foreign capital can be instrumental in the mobilization of funds as well as structural transformation. Fourth, the need for foreign capital be decreased immediately after structural changes actually happen (though foreign capital in the next period more productive).

EMERGING MARKET IN EMERGING COUNTRY

India had suffered economic devastation that had been built through joints new order policies began to crawl back drafting Foundation the economy. International Financial Corporation (IFC) the potential classification of the stock exchange with the classification of countries. If the State is still classified as a developing country, so the market in that country also in the developing stage, though its stock exchanges fully functional and well organized.

Developing the capital market can be identified through a country, whether that country is a developed country or developing country belongs. Per-capita income is a charge indicators will of a country, usually included in the medium-to low-income countries. But the most striking characteristic is its market capitalization value seen i.e. the number of companies listed, the cumulative trading volume, the tightness of the regulation of the capital market, to the sophistication and culture of its domestic investors.

The consequences of capital markets burgeoning market capitalization value is small. The size of a market capitalization is usually seen from comparison with the ratio of the value of a country's gross domestic product. In addition other consequences is there a trade transaction volume is thin (thin trading) caused synchronous trading on the market. Not synchronous trade caused by the large number of securities that are not entirely noted traded, it means there is some specified time in which a securities transaction does not occur (Hartono, 2003).

India which is still listed on the IFC is still as a developing country with the worst investment climate in East Asia regional. Although with a record like that, in fact we are still considered by foreign investors. The fact that there are national companies in fact are in a strategic sector of the country, by some foreign institutions be negotiable through acquisition of stock. There is a flow of funds entered as investments that generally is the foreign investment should be a macro-economy as a lift.

The main reason foreign investors move their funds into developing countries is because developing countries have the potential-potential businesses that haven't excavated entirely, as in the classic motifs of investment to other countries. Michael Fairbanks and Stace Lindsay senior consultant at Monitor Company elaborated the purpose of foreign investors coming to the poor countries that is usually only see an opportunity to draw in natural resources, cheap labor and wages as a target product or the service is not good quality.

But there is another reason that accompany the motif, namely the striking difference with the developed countries. If we use the business life cycle approach thus developing countries fall into the category growing (growth) than developed countries that fall into the category of mature (mature). It means that there is the attraction of high economic growth which is of course accompanied by a high return anyway, because economic growth is an indicator of aggregate from the industry in a country. For example, a business telecommunications provider in India that is solid in new worked on in Java island alone, while outside it's still high potential for new market share.

THE ROLE OF GOVERNMENT AND DOMESTIC INVESTORS IN THE CAPITAL MARKETS BURGEONING

Mark Mobius practitioners and experts in the industry suggests that international investment with the introduction of foreign investors into the market of course serves as a catalyst, that encourage local investment. Foreign capital coming into certain countries allow businesses in those countries to grow at a rate faster than if only mobilize domestic resources.

It's just the flow of money coming from portfolio investment is often cause for concern just the flow of hot money from other countries. The flow of funds is often known as the capital fight is seen by the Government as a speculative investment, unreliable and prone to adventurous activities take profit (profit taking) in the capital market. At a later stage funds like this will cause instability in the domestic economy.

The Problem has always been a scourge in this capital markets have actually voiced by many economists and practitioners, regulator in this industry. It's just that we just like to hear a information coming from out of the left ear right ear. The problem is to make these investment funds flow quality not quantity flow of funds. The quality of the investment is the amount of funds invested in the long term that is used to build the real sector.

Simply put is to maintain an macroeconomic stability (e.g. inflation under control, the economy growing, etc.), one way to make it happen is to create a system of fair and competitive markets. Competitive and fair means that there is no party that benefited in excess due to the biased information and vice versa. For example the existence of wild charges that rampant in our country are carried out by persons netted in a logbook, with the levy paying company streamed for example, in the management of permissions than the company that do not do it. Levy also contains wild uncertainty high prices because there are no clear standards and done illegally. Wild charges can be categorized as a result of the cost burden of the risks that lead to higher production costs.

Douglass North raised the transaction costs associated with the performance of the overall economy, the lower the transaction costs then the country will increasingly experience economic growth that can be sustained. Specifically, Gayle p. w. Jackson in his article entitled Governance for Modern markets suggests that to reduce uncertainty due to transaction costs can be done with the covers, clear ownership of the system, the use of standards, a rich resource and increases, a strict regulator, has databases and ensure smooth distribution of information so that the competitive climate occurs in order to reduce the information asymmetry.

The role of Government as a function of the regulator is not enough because of the sophisticated and as tightly as any regulation when it is not done with awareness (awareness) that high would walk half-measures and the next every performer will always find the gap of such regulations. The Government should also be fit for a role as a guarantor that gives reassurance to investors both domestic and foreign. Economic certainty guarantee was not enough, the Government is somehow the way should be able to provide legal certainty and assurance of political conditions. Because two of these factors are also closely related to the human resource culture factor.

Utopian Trinkets that had made a major campaign by the Government should have started to really run. The hope is the onset of effects can seep down (trickle down effect) is to change the culture, mannerisms and behavior of Governments that give moral support to the community. But this may not necessarily be able to succeed by itself, the Government should also be able to guide people to venture into domestic investor so a movement from bottom to top (bottom up).

The capital markets as it has a tendency of high return but high risk anyway. The momentum of the flow of foreign funds during the India capital market should also be welcomed by domestic funds flow to be able to increase the market capitalization. That way the role of the capital market as the driving force of the wheels of development and enhancing the welfare of society can be realized. Capital markets is not only dominated by one or two groups alone but is an integrated system for moving together between the Government, business, and society.

No comments:

Post a Comment