Up to now this show we’ve appeared at the income declaration and stability sheet for Apple, Inc. The final financial declaration I’m going to discuss is the cash flow declaration. Money circulation is the real difference in a company’s money stability during a specific time period. Examining the money movement statement is the most essential option to gauge the wellness of an organization. The cash circulation statement shows you in which the cash is coming from and where it’s going. The cash which is used to meet the daily basis small expenses being recorded in the petty cash report. This report is analyzed at daily basis for example it have an opening balance and after adding all the small expenses on that day the closing balance should match the actual petty cash which you have. The copy of Free OpenOffice Petty Cash Report Template can be easily downloaded from the internet.

The Easiest Way to Read a Cash Flow Statement

The Easiest Way to Read a Cash Flow Statement

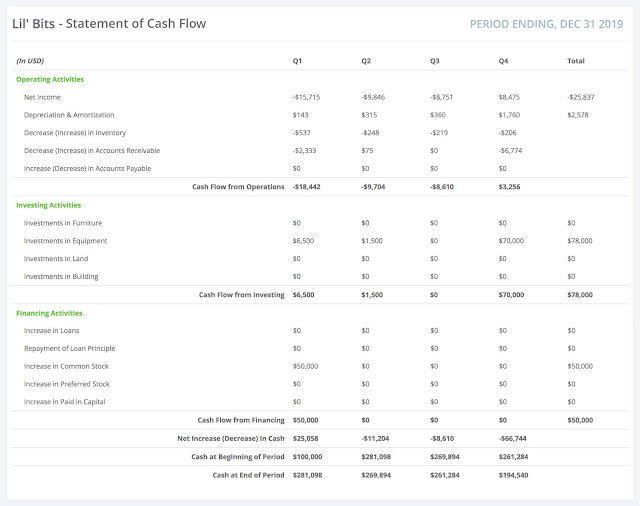

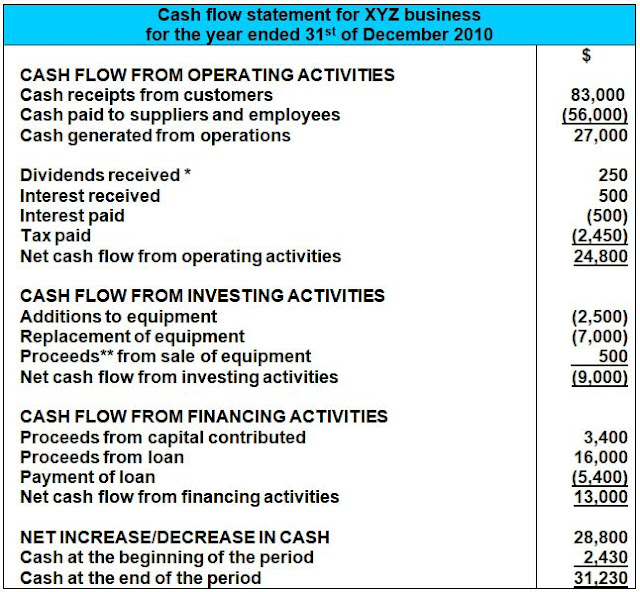

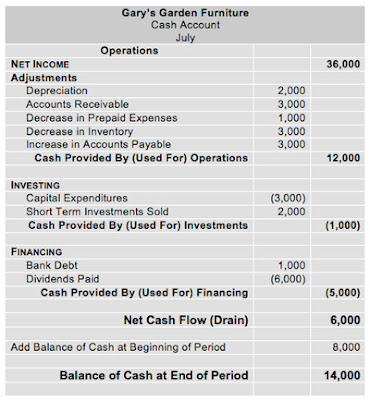

The cash flow declaration stops working your cash deals into three individual groups: running, Investing, and Financing Activities.

Money Movement from Operating Activities:-

The very best way to clarify cash circulation from spending activities will be teach you the way it’s calculated. Right here are the actions to estimate it:

1) Begin with web income

2) Include depreciation

3) Add deferred earnings (the money got up front side for a sale that hasn’t billed however)

4) Subtract the rise in accounts receivables and inventory (If receivables and inventory go up, cash goes down and vice versa)

5) Include the surge in accounts payable (If payables go up, so does money balance)

This calculation gives you the money movement from operating activities. If you have any queries feel free to ask myself in the comment area below.

Cash Circulation From Investing Activities:-

The money expenses and assets that Apple made are accounted for under cash circulation from operating activities. Capital expenditures are repayments for residential property, plant, and gear. Investments range from the acquisition and sale of marketable securities.

*After closer examination, it appears that Apple has negative money flow this period because they spent lots of money in marketable securities. Relating to their annual report on SEC.gov, they bought $102B of marketable securities and received $70B in profits from product sales, resulting in a web difference of $32B in unfavorable money movement for tasks pertaining to trading. This provides me with some convenience as a buyer. I’d much instead this be the reason behind unfavorable money circulation vs. not obtaining receivables or moving inventory.

Money Flow from Financing Activities:-

Financing activities are the repayment of dividends, purchase or purchase of company stock, and borrowing activity. Apple issued $831M shares of its very own stock and paid a $520M finance fee last year. They don’t spend a dividend to shareholders. As you can see from above, Apple finished the entire year with bad money circulation of $1.446B. In accordance with the balance sheet, their particular money balance fell from $11.261B in 2010 to $9.815B last year. After taking a better look, we discovered that Apple invested a considerable quantity of cash in marketable securities which lead to unfavorable cash circulation for the 12 months. Despite having a bad money circulation, Apple nevertheless finished the 12 months with a nearly $10B money stability.

*If you’d like to see the real financial statements of a publicly had business like Apple check away SEC.gov. Only enter in the company title or ticker expression and then mouse click the report you’d like to view (the yearly report is recorded as 10-K).

For those who have any questions about the cash circulation declaration or some of the financial statements we talked about, don’t wait to inquire about myself when you look at the remark area below. Learning to review economic statements was the single from many crucial things I learned during my MBA program. Hopefully, within the 9 minutes or more that it got one to review my 3 articles on economic statements.

Fast Story:-

Before I sign off, I’d choose to offer you a fast tale. About 10 years ago, before my formal company education, I bought my very first stock – Sirius Satellite broadcast (SIRI). This was just before the merger with XM Satellite broadcast. A pal of my own suggested that we appear it over, therefore I did. My study involved reading a couple of paragraphs about the company and thinking it over for around 30 minutes before I made the acquisition. We purchased 2000 stocks. Most likely, this stock was going to make myself wealthy.

I held the stock for a couple of years until I attended my first business school course on how to review economic statements. We distinctly keep in mind going home one evening after class and seeking within the financial statements for Sirius Satellite broadcast the very first time. My center sunk as I scrolled through their monetary info.

After reviewing the statements, I noticed that I spent nearly all of my entire life savings in a company which had never turned a revenue! It had been a terrible financial investment. we looked rapidly over my neck to see if anyone had observed the stupid choice that I made (just as if any person ended up being viewing myself at house to my computer system). Then I signed into my investment account and I also devote a sell purchase.

I couldn’t wait for the market to start up the following time in order for we really could discover some poor heart to acquire my stocks. Fortunately, I liquidated my position and wandered away without shedding my shirt. It ended up being a close one.

Accounting ratios Thanks for taking the time to discuss this, I feel strongly about it and love learning more on this topic. If possible, as you gain expertise, would you mind updating your blog with extra information? It is extremely helpful for me.

ReplyDelete