It is important to first note that every employee of an organization is entitled to a Salary Slip. Whether you are a casual or permanent employee, you deserve to know how your net pay is derived and why deductions were made on your gross earnings by having an access to your Pay Slips. No matter how consistently you have been receiving a Salary Slip or how detailed the information is in the slips, they will be useless if you do not understand them.

So, the most important function of a Salary Slip you received, which is to give clarity of wages and deductions to an employee, is defeated.

Consequently, let’s take a look at the different items in a Salary Slip document and consider what they meant.

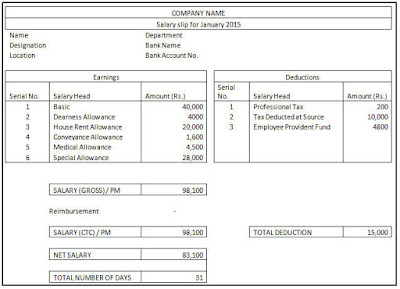

Here is a good looking Salary Slip Template created using MS Word.

So, the most important function of a Salary Slip you received, which is to give clarity of wages and deductions to an employee, is defeated.

Consequently, let’s take a look at the different items in a Salary Slip document and consider what they meant.

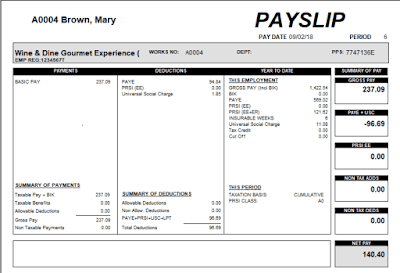

Employer’s Details:

A Pay/Salary Slip will bear the name and the logo of the initiator, usually the employers. This is necessary because a Salary Slip can be issued by several other millions of companies across the world. It helps to keep track of the initiators no matter how long it was issued.Date of Issuance:

This is the time the Salary Slip is issued to the employee. It is usually a few around the time the wages are disbursed to the bank. It could be a day before or after such payments are made.Pay Roll or Staff Number:

These are unique numbers assigned to individual staff members in an organization. There may also be a couple of other numbers and codes that are issued to the employee by a third party. An example is a tax code.Period Covered by The Pay Slip:

This is the specific period that the payments and the deductions on the Salary Slip are designed to cover. It can be daily, weekly, bi-weekly or monthly payments plans.Gross Pay:

This is the total earning accruing to the recipient of the Salary Slip before any form of deduction is made.Basic Salary:

This is allowed to be taxed 100%. Unlike other sections of your remunerations like housing, leave allowance, transportation and so on, this is where the bulk of tax deductions are made.Net Pay:

This is the amount that is payable to the recipient or the employee after all the necessary deductions on the gross pay are made.Department of Work:

The section of work, also called department of work is also mentioned.Salary/Staff Grade:

How employees’ experience and level are grouped together are explained trough grades.Leave Allowances:

It is usually paid once in a year.Pension:

This is the routine deductions from an employee’s income together with a contribution from the employer and remitted into his/her pension account for future purpose.

Deductions:

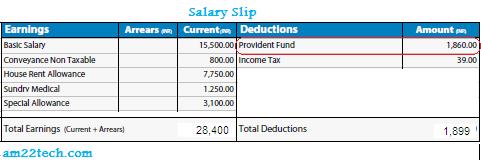

There are different kinds of deductions. Why some are routine and general, others are not. For instance, taxes like PAYEE, commission, union dues and insurances are routine while other deductions like medical expenses and official loans are based on individual activities and demands.Here is a good looking Salary Slip Template created using MS Word.

Download free salary slip format in excel Only at ExcelTMP.com

ReplyDeletehttps://exceltmp.com/salary-slip-format-in-excel-free-download/

excel sheet or word sheet of slip 1 template

ReplyDelete