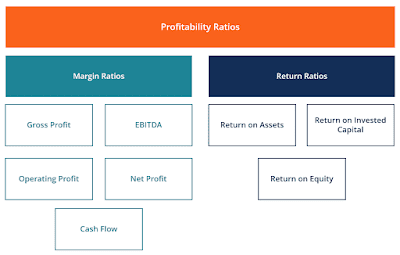

A ratio of Profitability is the ratio used to measure a company's ability to generate profit (profit) of the revenue (earning) related to sales, assets and equity. A couple of the profitability ratios are often use to measure the ability of the company. The profit of which such Margin gross profit (Gross Profit Margin), net profit Margin (Net Profit Margin), Return on Assets (ROA), Return on Equity (ROE), Return on Sales (ROS), Return on Capital the self-employed (ROCE). Ratio-the ratio of Profitability is basically use to indicate how good companies can earn profits or profit from their operations.

Investors or creditors can use this ratio-the ratio of profitability to assess. The return on investment based on the level of use of assets and other resources. In other words, this Profitability Ratios are use to assess whether the company generates enough profit from the assets and equity of the company. This Profitability ratio shows how efficient the company uses its assets to generate profits.

In the calculation of this ratio-the ratio of profitability, the higher the value of the ratio the better. A high value means the company is doing well and efficiently in generating profits, revenues and cash flow.

Ratio-the ratio of Profitability will provide information. That is more meaningful when compare with competitors or compare to the ratio in the previous period. Therefore, the analysis of trends or industry analysis is required to infer meaning about the profitability of a company.

The following are some commonly used profitability ratio to measure the ability of a company to generate profit from their business operations.

The gross Profit Margin or gross profit Margin is a profitability ratio used to calculate the percentage of the excess income gross profit sales. The gross profit reveals how big the profit gained by the company consider the cost incurred to produce the product or service. A gross profit margin is often refer to also by Gross Margin Ratio (the ratio of gross margin)

Gross Profit Margin = Gross Profit/Sales Revenue

The Net Profit Margin or net profit Margin is a profitability ratio calculates the percentage of the excess of net profit after tax income sales. Net profit margin is also known with the Profit Margin Ratio (ratio of Profit Margin)

Net income margin = net profit after taxes/sales revenue

The return on Assets or Asset Level is the ratio of profitability that shows the percentage of profits that accrue to the company in connection with the overall resources or total assets. Return on Assets or often abbreviate with the ROA is the ratio that measures how efficient a company is managing its assets to generate profits for a period. ROA express in percentage (%).

The Return on Assets (ROA) = net profit after Taxation/Total assets (or average total assets)

Return on Equity Ratio (the ratio of return on Equity)

A return on Equity Ratio or ratio of return on equity is usually abbreviate with ROE is the ratio of profitability that measures the company's ability to generate profits from the investment of shareholders in the company. ROE is express in percentage (%)

Return on Equity (ROE) = net profit after tax/shareholder's equity

A return on Sales or Sales Return Ratio is the ratio of profitability. That shows how much profit is generate by a company after paying. The variable costs of production such as labor wages, raw materials and others (but before tax and interest).

In other words, return on Sales it is a ratio that shows the level of benefits. Which can be obtain from any Indonesian rupiah after its sale. The ratio of return on Sales is also refer to as Operational Margin (Operating Margin) or operating income Margin (Operating Income Margin). ROS is also express in percentage (%).

The Return on Sales (ROS) = earnings before Interest and Taxes/sales

Return on Capital the self-employ (working capital Repayment)

Return on Capital the self-employ or simply with the profitability ratio of ROCE is use to measure the benefits that accrue to the company of capital use. ROCE is commonly use in the form of a percentage (%). Capital that is use is equal to the equity of an enterprise. That is couple with a duty not smoothly or Total assets less current liabilities. ROCE indicates the efficiency and profitability of the capital investment company.

ROCE = profit before tax and interest/working capital.

Or

ROCE = profit before tax and interest/ (Total Assets – current liabilities).

Earnings before tax and Interest is profit that does not incorporate. The interest expenses and income tax, in the is often refer to with the term "EBIT" i.e. Earnings Before Interest and Tax.

Investors or creditors can use this ratio-the ratio of profitability to assess. The return on investment based on the level of use of assets and other resources. In other words, this Profitability Ratios are use to assess whether the company generates enough profit from the assets and equity of the company. This Profitability ratio shows how efficient the company uses its assets to generate profits.

In the calculation of this ratio-the ratio of profitability, the higher the value of the ratio the better. A high value means the company is doing well and efficiently in generating profits, revenues and cash flow.

Ratio-the ratio of Profitability will provide information. That is more meaningful when compare with competitors or compare to the ratio in the previous period. Therefore, the analysis of trends or industry analysis is required to infer meaning about the profitability of a company.

Types of ratio of Profitability (Ratio of Profitability)

The following are some commonly used profitability ratio to measure the ability of a company to generate profit from their business operations.

Gross Profit Margin (Gross Profit Margin)

The gross Profit Margin or gross profit Margin is a profitability ratio used to calculate the percentage of the excess income gross profit sales. The gross profit reveals how big the profit gained by the company consider the cost incurred to produce the product or service. A gross profit margin is often refer to also by Gross Margin Ratio (the ratio of gross margin)

Gross Profit Margin = Gross Profit/Sales Revenue

Net Profit Margin (Net Profit Margin)

The Net Profit Margin or net profit Margin is a profitability ratio calculates the percentage of the excess of net profit after tax income sales. Net profit margin is also known with the Profit Margin Ratio (ratio of Profit Margin)

Net income margin = net profit after taxes/sales revenue

Return on Assets Ratio (the ratio of return on assets)

The return on Assets or Asset Level is the ratio of profitability that shows the percentage of profits that accrue to the company in connection with the overall resources or total assets. Return on Assets or often abbreviate with the ROA is the ratio that measures how efficient a company is managing its assets to generate profits for a period. ROA express in percentage (%).

The Return on Assets (ROA) = net profit after Taxation/Total assets (or average total assets)

Return on Equity Ratio (the ratio of return on Equity)

A return on Equity Ratio or ratio of return on equity is usually abbreviate with ROE is the ratio of profitability that measures the company's ability to generate profits from the investment of shareholders in the company. ROE is express in percentage (%)

Return on Equity (ROE) = net profit after tax/shareholder's equity

Return on Sales Ratio (the ratio of return on sales)

A return on Sales or Sales Return Ratio is the ratio of profitability. That shows how much profit is generate by a company after paying. The variable costs of production such as labor wages, raw materials and others (but before tax and interest).

In other words, return on Sales it is a ratio that shows the level of benefits. Which can be obtain from any Indonesian rupiah after its sale. The ratio of return on Sales is also refer to as Operational Margin (Operating Margin) or operating income Margin (Operating Income Margin). ROS is also express in percentage (%).

The Return on Sales (ROS) = earnings before Interest and Taxes/sales

Return on Capital the self-employ (working capital Repayment)

Return on Capital the self-employ or simply with the profitability ratio of ROCE is use to measure the benefits that accrue to the company of capital use. ROCE is commonly use in the form of a percentage (%). Capital that is use is equal to the equity of an enterprise. That is couple with a duty not smoothly or Total assets less current liabilities. ROCE indicates the efficiency and profitability of the capital investment company.

ROCE = profit before tax and interest/working capital.

Or

ROCE = profit before tax and interest/ (Total Assets – current liabilities).

Earnings before tax and Interest is profit that does not incorporate. The interest expenses and income tax, in the is often refer to with the term "EBIT" i.e. Earnings Before Interest and Tax.

No comments:

Post a Comment